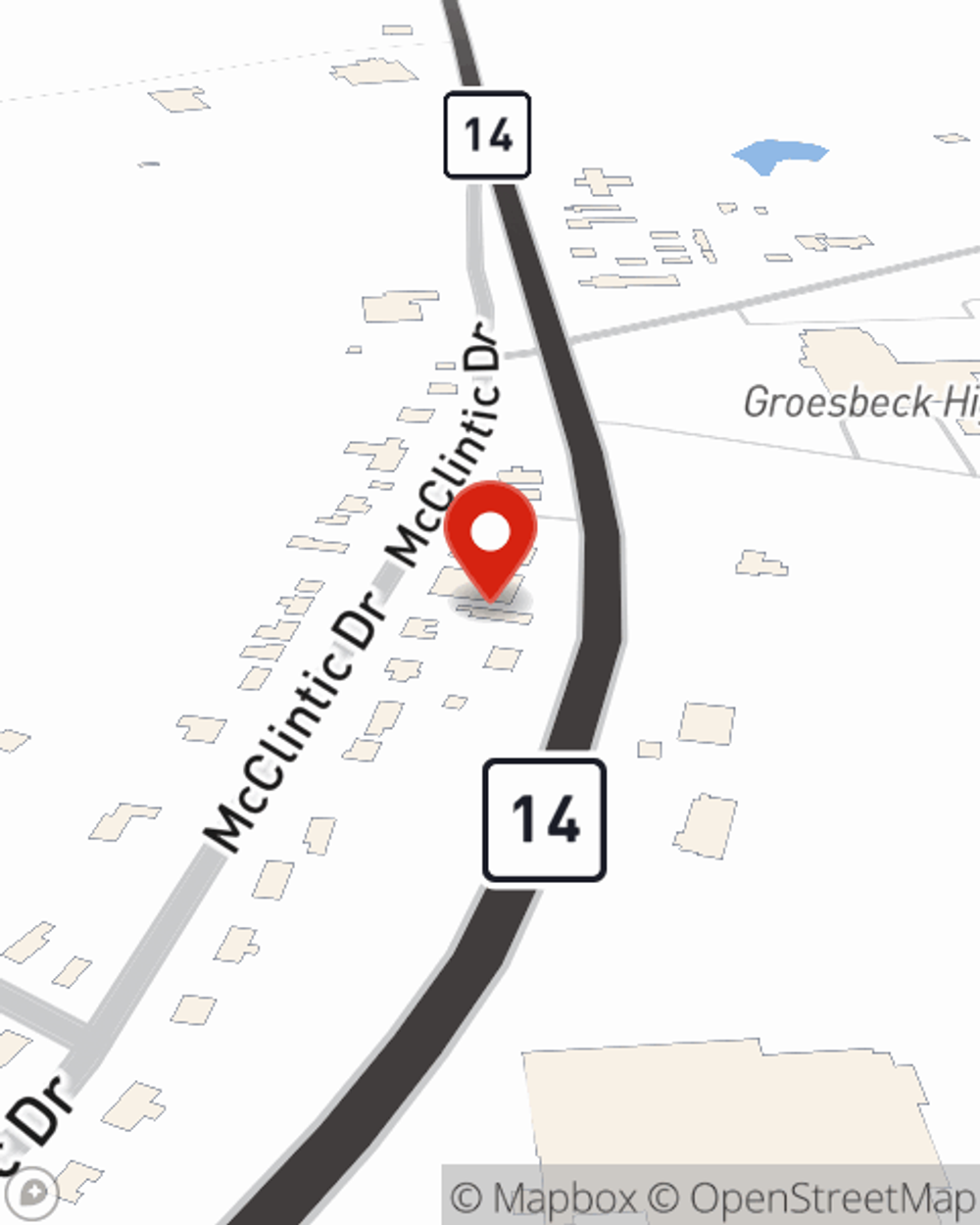

Business Insurance in and around Groesbeck

Get your Groesbeck business covered, right here!

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Whether you own a a cosmetic store, a toy store, or a home improvement store, State Farm has small business coverage that can help. That way, amid all the different moving pieces and options, you can focus on what matters most.

Get your Groesbeck business covered, right here!

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Will Hallmark. With an agent like Will Hallmark, your coverage can include great options, such as commercial auto, worker’s compensation and commercial liability umbrella policies.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Will Hallmark's team to learn about the options specifically available to you!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Will Hallmark

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.